Corporate Governance

Basic approach to corporate governance

The Company strives to strengthen corporate governance to sustainably enhance shareholder value and fulfill its responsibilities to diverse stakeholders. In addition to “ensuring transparency,” “increasing the speed of decisionmaking,” “enhancing ethics and legal compliance,” and “strengthening internal control,” we are working to further advance corporate governance by strengthening initiatives for “information disclosure” and “accountability.”

Principles of the Corporate Governance Code and RYODEN’s initiatives

The Company has formulated and disclosed “Principles of the Corporate Governance Code and RYODEN’s Initiatives,” which summarizes the Company’s initiatives to address each principle in the Corporate Governance Code, in accordance with its basic approach to corporate governance since FYE2023.

-

Principles of the Corporate Governance Code and RYODEN’s initiatives (

PDF | 965KB )

-

Corporate Governance Report (

PDF | 1.3MB )

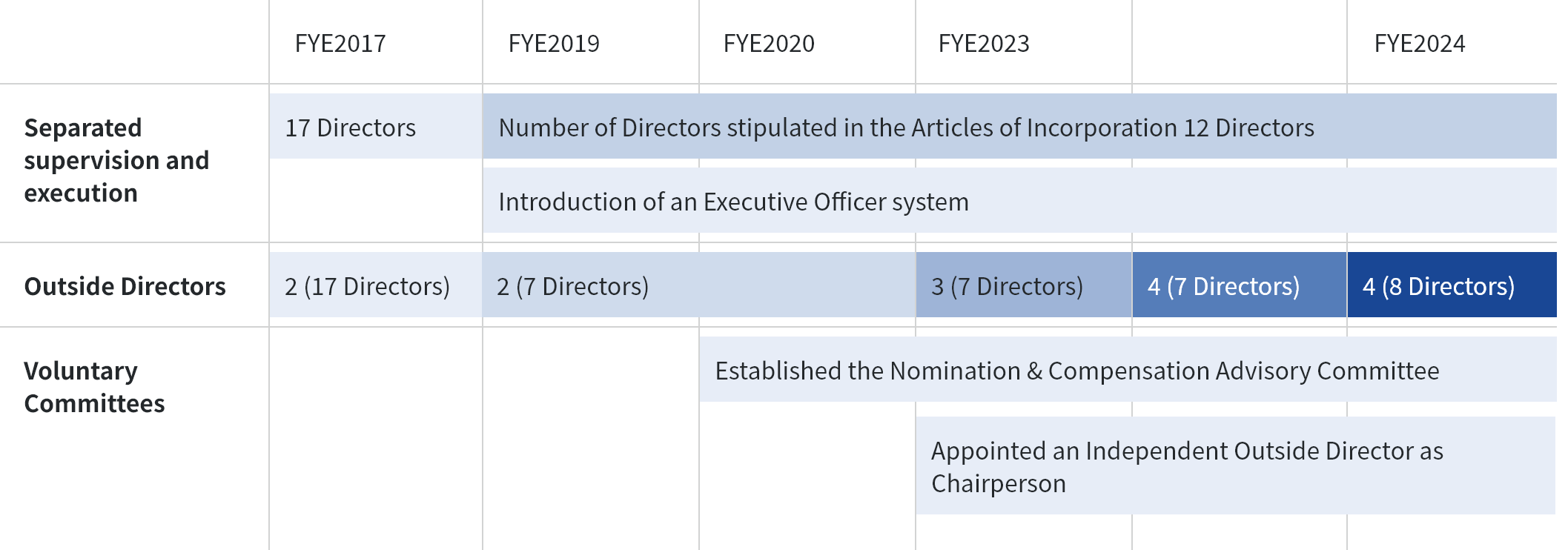

Strengthening corporate governance

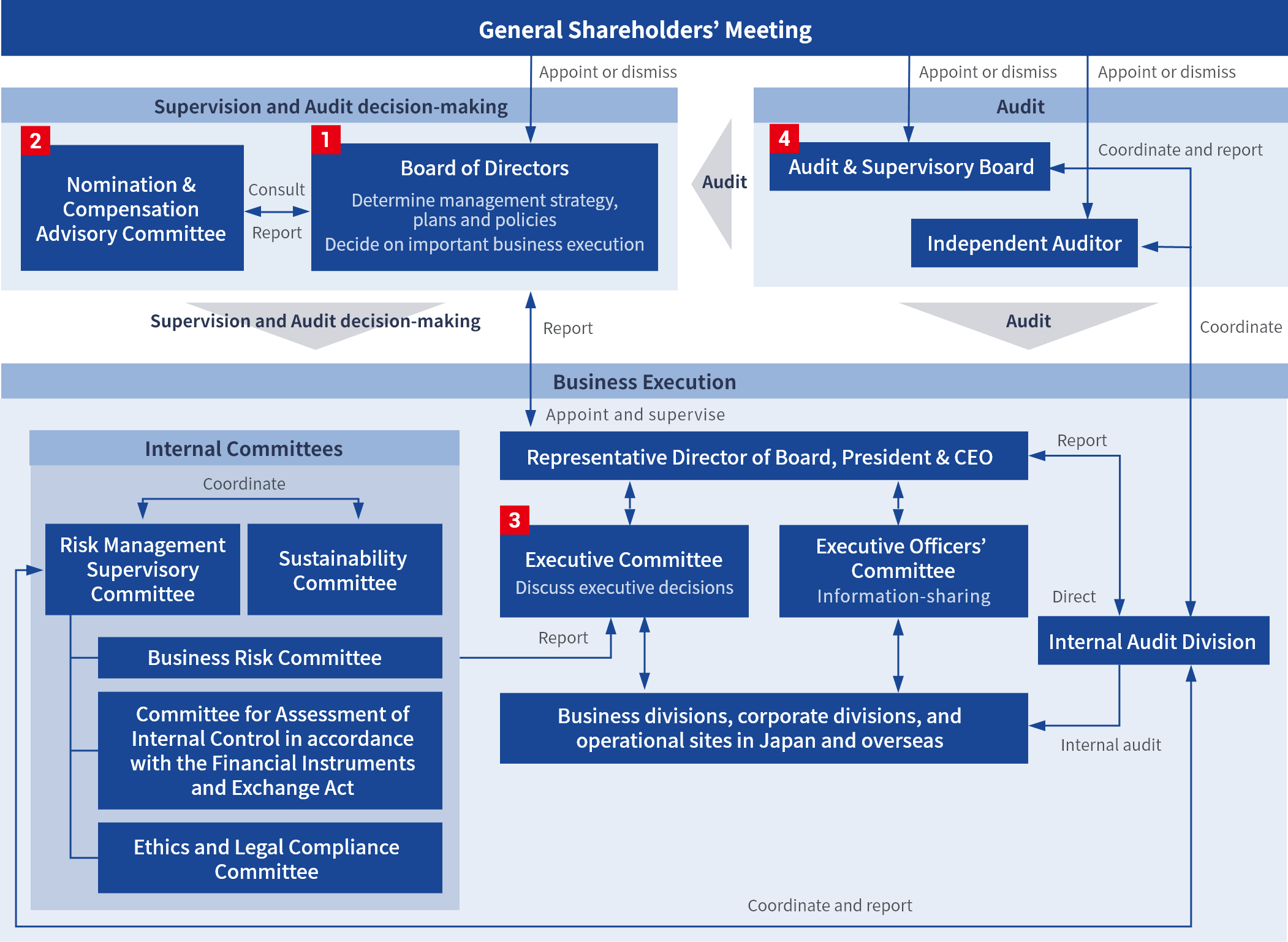

Corporate governance system

The Company has adopted the current structure of a company with an Audit & Supervisory Board, because it considers that a system of double checks involving the Board of Directors and the Audit & Supervisory Board will secure the appropriateness of operations. The Board of Directors consists of eight Directors, four of whom are Outside Directors. It makes decisions on important matters of business execution, and supervises business execution by Directors. The Audit & Supervisory Board is composed of four Audit & Supervisory Board Members, two of whom are Outside Corporate Auditors. It ensures independence from business executers in supervising the execution of business by Directors, in coordination with the Independent Auditor and the Internal Audit Division.

Composition of each body

◎=Chair or Chairperson 〇=Attending member

| Rank | Name | 1Board of Directors | 2Nomination & Compensation Advisory Committee | 3Executive Committee | 4Audit & Supervisory Board |

|---|---|---|---|---|---|

| President and representative director | Katsuyuki Tomizawa | ◎ | ◎ | ||

| Director of Board, Senior Vice President | Shoji Kitai | ○ | ○ | ○ | |

| Director of Board, Senior Executive Officer | Takahiro Ozawa | ○ | ○ | ||

| Director of Board, Senior Executive Officer | Shunichi Higashi | ○ | ○ | ||

| Outside Director | Gorou Fujiwara | ○ | ○ | ||

| Outside Director | Masahiro Muroi | ○ | ◎ | ||

| Outside Director | Thomas Witty | ○ | ○ | ||

| Outside Director | Hideki Matsuo | ○ | ○ | ||

| Corporate Auditor | hiroshi Hiraide | ○ | ○ | ◎ | |

| Corporate Auditor | Hirozou Tomomori | ○ | ○ | ○ | |

| Outside Corporate Auditor | Masato Suzuki | ○ | ○ | ||

| Outside Corporate Auditor | Noriko Sekiguchi | ○ | ○ | ||

| Senior Executive Officer | Kazumoto Yogosawa | ○ | |||

| Senior Executive Officer | Ko Oniwa | ○ | |||

| Senior Executive Officer | Yasumaru Tokiwa | ○ |

-

1Board of Directors(Meetings in FYE2022: 14)

As the management top decision-making body, the Board of Directors decides on important matters concerning the Company’s execution of business, and supervises the execution of duties by Directors. The Company has introduced an Executive Officer system in order to increase the speed of decision-making, separate oversight functions and execution functions, and to enhance agility of execution, so as to appropriately respond to the business environment in which the Company operates. At the Ordinary General Meeting of Shareholders held in June 2018, the Articles of Incorporation was amended to set the number of Directors at 12 or less. The Board of Directors is presently composed of eight Directors (including four Outside Directors, of which three are Independent).

-

2Nomination & Compensation Advisory Committee(Meetings in FYE2022: 9)

RYODEN CORPORATION has established a Nomination & Compensation Advisory Committee, in order to ensure the fairness, transparency and objectivity of the processes regarding the nomination and compensation of Directors and to improve its corporate governance. The Nomination & Compensation Advisory Committee, upon consultation from the Board of Directors, deliberates and provides advice on matters regarding the nomination and compensation of Directors to the Board of Directors. A majority of the members are Independent Outside Directors, and the Committee is chaired by Masahiro Muroi, an Outside Director.

-

3Executive Committee(Meetings in FYE2022: 28)

RYODEN CORPORATION has established the Executive Committee to deliberate the agenda to be submitted to the Board of Directors as well as important matters regarding RYODEN CORPORATION’s business execution. At present, the Executive Committee is composed of the President and representative director and six Executive Officers with titles. Corporate Auditors also attend the meetings.

-

4Audit & Supervisory Board(Meetings in FYE2022: 5)

RYODEN CORPORATION’s Audit & Supervisory Board comprises two Corporate Auditors and two Outside Corporate Auditors. Each Auditor attends the meetings of the Board of Directors as well as other key meetings in accordance with the audit policy and audit plan determined by the Audit & Supervisory Board, and audits and oversees legal compliance by the Directors in performing their duties, by verifying reports from Directors and employees of the Company and the Group and conducting investigations into the business operation and financial situations of each company.

Overview of the corporate governance system

| Organizational form | Company with an Audit & Supervisory Board |

|---|---|

| Number of Directors (of which, Outside Directors) |

8 (4) |

| Term of office of Directors | 1 year |

| Number of Outside Directors designated as Independent Directors | 3 |

| Number of Auditors (of which, Outside Corporate Auditors) |

4 (2) |

|---|---|

| Adoption of an Executive Officer system | Yes |

| Establishment of voluntary committees | Yes (Nomination & Compensation Advisory Committee) |

| Compensation system | 1 Fixed compensation 2 Bonuses 3 Stock-compensation-type stock options |

Views on the balance of knowledge, experience, and skills, and the diversity and size of the Board of Directors

In order to ensure the Board of Directors make decisions and fulfill supervisory functions quickly and decisively in a transparent and fair manner to a maximum degree, achieve the RYODEN Group’s sustainable growth, and increase its corporate value over a medium to long term, we work to ensure that the Board is formed in a way that allows it to achieve the overall right balance between knowledge, experience and skills, and achieve diversity in gender and international mindedness and an optimum size. Furthermore, we strive to ensure Independent Outside Directors represent one-third of the Board.

Matrix of the skills of management members

| Corporate management | Industrial knowledge | Global business | ICT / DX | Financial accounting | Legal affairs / risk management | Governance / sustainability | Diversity / experience in other industries※ |

|

|---|---|---|---|---|---|---|---|---|

| Representative Director of Board, President & CEO Katsuyuki Tomizawa | ○ | ○ | ○ | ○ | ○ | |||

|

Representative Director of Board Senior Vice President Nomination & Compensation Advisory Committee Member Shoji Kitai |

○ | ○ | ○ | ○ | ○ | ○ | ||

|

Director of Board Senior Executive Officer Takahiro Ozawa |

○ | ○ | ○ | |||||

|

Director of Board Senior Executive Officer Shunichi Higashi |

○ | ○ | ○ | ○ | ||||

|

Outside Director Nomination & Compensation Advisory Committee Member Gorou Fujiwara |

○ | ○ | ○ | ○ | ||||

|

Outside Director (Independent) Nomination & Compensation Advisory Committee Chair Masahiro Muroi |

○ | ○ | ○ | ○ | ||||

|

Outside Director (Independent) Nomination & Compensation Advisory Committee Member Thomas Witty |

○ | ○ | ○ | ○ | ○ | |||

|

Outside Director (Independent) Nomination & Compensation Advisory Committee Member Hideki Matsuo |

○ | ○ | ○ | ○ | ○ | |||

| Corporate Auditor hiroshi Hiraide | ○ | ○ | ||||||

| Corporate Auditor Hirozou Tomomori | ○ | ○ | ||||||

| Outside Corporate Auditor Masato Suzuki | ○ | ○ | ○ | |||||

| Outside Corporate Auditor Noriko Sekiguchi | ○ | ○ | ○ | ○ |

- ※Defined as the knowledge needed to realize soundness, transparency and sustainable growth.

Evaluation of the effectiveness of the Board of Directors

Method of evaluation

A self-assessment survey on the effectiveness of the Board of Directors in FYE2023(from April 2022 to March 2023) was conducted on all members of the Board of Directors, with the aim of confirming and enhancing the effectiveness of the Board of Directors. This fiscal year, a meeting was held to exchange opinions between Independent Directors and Corporate Auditors only, for the purpose of receiving the unreserved opinions of Independent Directors and Corporate Auditors.

Summary of the survey

| Respondents | Directors and Corporate Auditors |

|---|---|

| Method | Anonymous survey |

| Content | ①Composition of the Board of Directors ②Operation of the Board of Directors ③Debate by the Board of Directors ④Operation of the Nomination & Compensation Advisory Committee etc. |

| Questions | 28 questions in total (including five free-response questions) |

Evaluation results and future initiatives

The Company’s Board of Directors engages in constructive and vigorous discussions. Aspects such as the composition and size of the Board of Directors, including securing diversity, its operation and discussions, and the operation of the Nomination & Compensation Advisory Committee were all evaluated as being generally appropriate and effective.

However,Outside Directors and Auditors have pointed out that the following correct improvements should be made for each item.

(1) Composition of the Board of Directors

- Train and appoint female officers within the company.

- Set a target for the percentage of female Directors.

- Enhanced education and training for senior management in order to secure expertise in financial accounting skills, management environment, etc.

- Diversity such as age should be ensured.

(2) Operation of the Board of Directors

- The audio equipment should be improved for web participation.

- Preparation and explanation of materials that focus on areas that should be focused on, such as risks, should be further accelerated in order to ensure sufficient time for reviewing agenda items.

- Prompt provision of information on important matters to outside officers.

(3) Discussion at the Board of Directors

- There is still a lack of discussion on important medium- to long-term themes such as management strategy, diversity, sustainability, and human resource development.

(4)Nomination & Compensation Advisory Committee

- It should be possible for board members to better understand the status of activities and the content of discussions.

(5)Others

- It should be prioritized.

- Evaluation of effectiveness of the Board of Directors should focus on the effectiveness of the company's governance, management strategies, management efficiency, etc., rather than formalities.

- The results should not only be reported to the board of directors, but should also be discussed and improved.

Based on the results of this year's survey, the Company will work to select themes that will lead to more effective discussions, improve the content and timing of providing materials for the Board of Directors, and enhance on-site inspections by outside officers. Regarding Evaluation, going forward, the Company will conduct a fundamental Evaluation of whether the activities of the Board of Directors are leading to the improvement of our corporate value over the medium to long term.

Introduction of external perspectives

The Company currently has four Outside Directors and two Outside Corporate Auditors. The Outside Directors, drawing on their respective abundant experience and wide-ranging knowledge, provide advice concerning operations and supervise execution. Outside Corporate Auditors, from their objective and independent stances, monitor and oversee the status of management execution in cooperation with Corporate Auditor and conduct audits to ascertain whether the execution of duties by Directors is in compliance with laws and regulations and the Company’s Articles of Incorporation through examination of the design and operation of internal control systems of the Company and the Group.

| Name | Independent | Reason for appointment | Meetings attended in FYE2022 | ||

|---|---|---|---|---|---|

| Board of Directors | Audit & Supervisory Board | ||||

| Outside Director | Gorou Fujiwara Newly appointed |

Mr. Fujiwara serves as General Manager of Market Planning & Administration Department in Mitsubishi Electric Corporation’s Corporate Marketing Group and has a wealth of experience and broad knowledge in the industry the Company operates in. The Company has judged that he will be able to contribute to the supervisory function on the overall management of the Company from an objective standpoint as Outside Director. | - | - | |

| Masahiro Muroi | ○ | Mr. Muroi has a wealth of knowledge and experience in corporate management, corporate governance and digital transformation, among others. He offers effective advice from the aforementioned viewpoints and an independent, objective standpoint. | 14/15 | - | |

| Thomas Witty | ○ | Having handled M&A deals for global companies for many years as an attorney, Mr. Witty has a wealth of experience and knowledge and has a depth of understanding of how Japanese companies are and their culture. The Company has judged that he will be able to offer advice to the management to help the Company grow globally, as well as contribute to reinforcing governance and supervising appropriate execution. | 11/11 | - | |

| Hideki Matsuo Newly appointed |

○ | In addition to corporate management, Mr.Matsuo has experience in global operations and is familiar with production and technology, and we have determined that Mr.Matsuo is able to give effective advice from these viewpoints and from an independent and objective standpoint. | - | - | |

| Outside Corporate Auditor | Masato Suzuki | ○ | Mr. Suzuki has many years of experience in corporate legal affairs as an attorney. He utilizes his specialized knowledge and wide-ranging experience to appropriately perform duties as an Outside Corporate Auditor. | 14/15 | 6/6 |

| Noriko Sekiguchi | ○ | As a certified public accountant, Ms. Sekiguchi possesses a wealth of experience in corporate accounting, advanced expertise and broad knowledge, as well as work experience in several companies. The Company has judged that she will appropriately perform duties as an Outside Corporate Auditor. | 11/11 | 4/4 | |

- Note: Outside Directors Gorou Fujiwara and Hideki Matsuo were newly appointed at the 83rd Ordinary General Meeting of Shareholders held on June 23, 2023.

Compensation for Directors and Auditors

Basic Policy on Compensation for Directors

- Increases medium- to long-term corporate value in line with the Company’s Management Principle

- Endeavors to share interests in common with shareholders

- Is explainable to stakeholders and determined through a transparent process

Policy for determining compensation for Directors and Auditors

Maximum total amounts of compensation for all Directors and Auditors, respectively, are determined through a resolution of the General Shareholders’ Meeting. Compensation amounts for Directors are determined by the Board of Directors through consultation with the Nomination & Compensation Advisory Committee, which comprises a majority of Outside Directors. Compensation amounts for Auditors are determined through discussion among Auditors. The details of and policy for determining compensation, etc. for Directors and Auditors are as follows:

| Class of Officer | Relevant officers | Approach for determining compensation, etc. | Resolutions on compensation, etc |

|---|---|---|---|

| Directors (8) |

Directors (internal) (3) |

Basic compensation (fixed compensation)

Performance-linked compensation (bonuses) |

|

Non-monetary compensation, etc. (stock-compensation-type stock options)

|

|

||

| Auditors (4) |

|

||

| Outside Directors (4) |

Auditors (internal) (2) |

|

|

| Outside Corporate Auditors (2) |

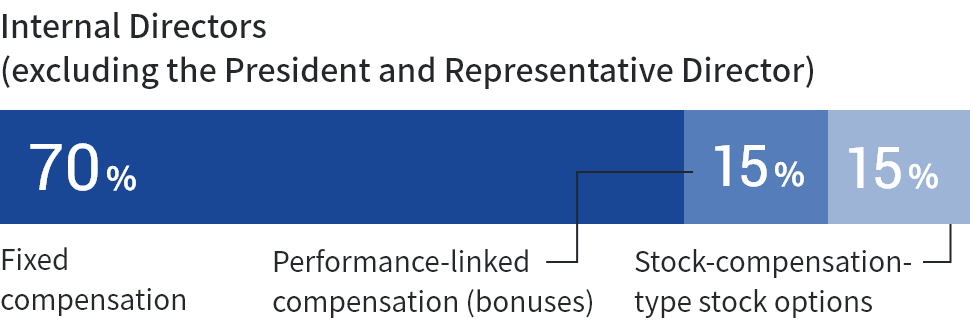

Percentage of each type of compensation

Compensation amounts for Directors and Auditors (FYE2022)

| Class of Officer |

Number of eligible Officers (persons) |

Amount of each type of compensation (millions of yen) | Total amount of compensation (millions of yen) | ||

|---|---|---|---|---|---|

| Basic compensation | Performance-linked compensation | Non-monetary compensation, etc. | |||

| Fixed compensation | Bonuses | Stock-compensation-type stock options | |||

| Directors | 7 | 108 | 25 | 19 | 153 |

| (of which, Outside Directors) | 2 | 14 | - | - | 14 |

| Auditors | 4 | 49 | - | - | 49 |

| (of which, Outside Corporate Auditors) | 2 | 12 | - | - | 12 |

- ※1The number of officers and the amounts of compensation shown above include 3 Directors and 2 Auditors who retired at the conclusion of the 82nd Ordinary General Meeting of Shareholders held on June 23, 2022. In addition, no compensation was paid to 1 of the 3 Outside Directors.

- ※2The amounts of bonuses shown above were the amounts paid to four Directors (excluding Outside Directors).

- ※3The amount of stock-compensation-type stock options shown above is the amount of expenses recorded pertaining to the grant of share acquisition rights as stock-compensationtype stock options to four Directors (Outside Directors are not eligible) in the fiscal year under review.

- ※4Profit attributable to owners of parent is used as the performance indicator for calculating stock-compensation-type stock options.

Training for Directors and Auditors

The Company’s newly-appointed Directors and Auditors (excluding Outside) attend external seminars, as well as undertake e-learning for listed companies provided by Tokyo Stock Exchange, Inc. after their appointment. In addition, Directors and Auditors actively participate in external seminars organized by consultants and bodies such as the Japan Auditors Association.