Internal Control / Risk Management

Internal Controls and Risk Management

The Company's basic policy regarding its internal control system is as follows:

1. System to ensure that the execution of duties by Directors of the Board and employees complies with laws and regulations and the Articles of Incorporation

- The Company considers compliance to be an important management issue, and has therefore established compliance rules and ensures that all officers and employees of the Company and its Group companies are thoroughly informed and trained.

- In order to strengthen and expand the internal control system of the Company and the Group, a "Risk Management Supervisory Committee," chaired by the Director of the Board, President & CEO, has been established to oversee activities related to internal controls.

- In order to ensure thorough compliance in corporate activities, the Company has established an "Ethics and Legal Compliance Committee," chaired by the Executive Officer in charge, which regularly determines and implements compliance-related promotion items, while the Internal Audit Division audits the compliance status of the Company and its Group companies.

- The "RYODEN Group Code of Conduct" stipulates a firm stance against anti-social forces, and the Company has established a system to ensure that all officers and employees of Ryoden and the Ryoden Group are fully aware of and abide by it.

- If an officer or employee of the Company or its Group companies becomes aware of a violation or potential violation of compliance, he or she may report it through the Hotline system and no adverse treatment will be given to the whistleblower.

- The Risk Management Supervisory Committee reports its activities to the Executive Committee and the Board of Directors, and is overseen by the Board of Directors.

- The Risk Management Supervisory Committee will exchange information with the Internal Audit Division on the status of its activities and the risks it has identified, and will implement effective risk management.

2. System for storing and managing information relating to the performance of the Directors of the Board pertinent to their duties

Documents and important records required by law or regulation to be retained, and other related materials (including electromagnetic records), shall be properly preserved and managed in accordance with internal rules and maintained in a condition that permits access when required.

3. Rules and other systems for managing the risk of loss

The Company has established a "Business Risk Validation Rule" regarding business risks to the Company and the Group, and the Business Risk Committee, chaired by the Executive Officer in charge, identifies risks and implements countermeasures based on the likelihood of occurrence, severity of impact, etc. In addition, the status of their activities is reported to the Risk Management Supervisory Committee, and the Company and the Group engage in multi-faceted risk management.

4. System to ensure efficient performance of the duties of the Directors of the Board

- The Company holds a regular meeting of the Board of Directors once a month to decide on important matters and to supervise the performance of the duties of each Director of the Board. In addition, the Executive Committee deliberates on matters to be brought before the Board of Directors in order to strengthen and streamline the functions of the Board of Directors.

- The Board of Directors determines the division of duties and authorities for each organization, clarifies the authorities and responsibilities of each organization, and establishes a system for the adequate and efficient performance of duties.

- In order to ensure effectiveness and efficiency, the Company and its Group companies shall clearly set target values for each fiscal year and manage the status of their implementation.

5. System to ensure the adequacy of the Group's business activities

- The Company shall require prior notification to, or approval by, the Company of any significant matter relating to any of the Group companies.

- The Audit & Supervisory Board members of each Group company and the Audit & Supervisory Board members and Internal Audit Department of the Company shall exchange information and cooperate in conducting audits of our Group companies to ensure the adequacy of the Group's operations.

6. System to ensure the adequacy of financial reporting

To ensure the adequacy and reliability of the financial reporting of the Company and the Group, the "Committee for Assessment of Internal Control" in accordance with the Financial Instruments and Exchange Act, chaired by the Executive Officer in charge, has been established to regularly evaluate the effectiveness of the system.

7. Matters relating to employees requested by an Audit & Supervisory Board member to assist him/her in the performance of his/her duties.

If deemed necessary by the Audit & Supervisory Board member, employees shall be appointed to assist the Audit & Supervisory Board member in consultation with the Directors of the Board.

8. Matters relating to the independence of employees engaged to assist the Audit & Supervisory Board members from the Directors of the Board in the performance of their duties and to ensure the effectiveness of instructions given by the Audit & Supervisory Board members to such employees.

- If employees are to be engaged to assist the Audit & Supervisory Board members, the Audit & Supervisory Board members and the Directors of the Board shall discuss in advance matters relating to the authority to appoint such employees.

- Such employees shall be subject only to the instructions and orders of the Audit & Supervisory Board members.

9. System for the Directors of the Board and employees to report to the Audit & Supervisory Board members, and other systems for reporting to the Audit & Supervisory Board members

- The officers and employees of the Company and the Group shall report to the Audit & Supervisory Board on the deliberations at important meetings, the results of internal audits and other important matters concerning the conduct of the business of the Company and the Group, and shall promptly report to the Audit & Supervisory Board any matters that may have a material impact on the business of the Company and the Group.

- The division in charge of the Company's Hotline system shall regularly report to the Company's Audit & Supervisory Board members on the status of whistleblowing by officers and employees of the Company and its Group companies.

- When requested by any Audit & Supervisory Board Member to report on matters relating to the conduct of business, the officers and employees of the Company and its Group companies shall report promptly on such matters.

- No officer or employee of the Company or its Group companies who makes a report to the Company's Audit & Supervisory Board members shall be treated less favorably by reason of having made such report.

10. Other systems to ensure that audits by the Audit & Supervisory Board members are conducted effectively

- The Audit & Supervisory Board and each Audit & Supervisory Board Member may engage such lawyers, accountants and other advisers as may be necessary for the performance of their duties.

- The Audit & Supervisory Board members shall ensure the effectiveness of the audits of the Company and its Group companies by exchanging information and cooperating with the Accounting Auditors and the Audit & Supervisory Board members of the Company's Group companies.

Risk Management

Risk Management System

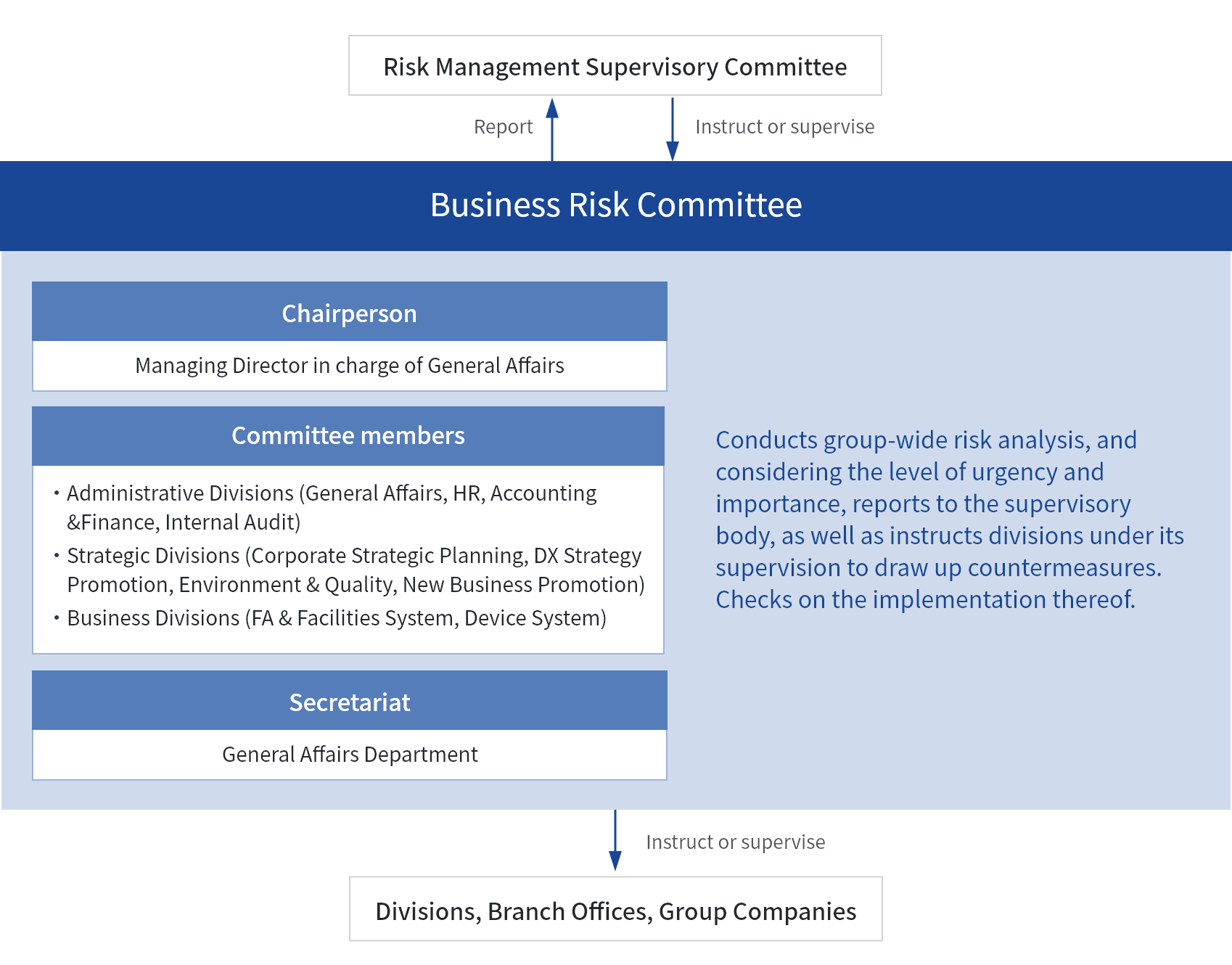

The Company has established "Basic Regulations on Risk Management" for the Group's risk management, and the Business Risk Committee, chaired by the Director of the Board in charge, analyses risks for the entire Group and manages the Group's multifaceted risks.

The Head of the Head Office Administrative Divisions and the General Managers of Business Headquarters are members of the committee. The Business Risk Committee analyses the risks of the entire Group, considers the likelihood of their occurrence and their impact, reports on the status of its activities to the Risk Management Supervisory Committee under its authority, instructs the relevant divisions to formulate countermeasures, and monitors the implementation of such countermeasures.

Operating status

In principle, the Business Risk Committee meets twice a year. This committee identifies risks related to the Group's activities and formulates measures to manage them, and reviews and assesses the effectiveness of the risk management system.

The meeting were held twice in FYE2023. We review and evaluate such as shortages of automotive semiconductors and rising purchase prices, relationships with major suppliers, country risks, financial risks due to the rapid depreciation of the yen depreciation, the automotive and industrial markets, countermeasures for delivery delays due to customer production adjustments, inventory risk due to increased shipments of advance orders to manufacturers, and other investment projects.

Business and other risks described in the Annual Securities Report are listed here*.